Gift House To Child Tax . for example, if you sell a $1 million house to your child for $600,000, that $400,000 discount is deemed a gift. Each option has its own risks. gifting property to children or family members is not only extremely generous but it can help reduce. parents can make an outright gift of a home to an adult child. this article discusses the two different ways of gifting (transferring) property in singapore, during the benefactor's lifetime, and by. parents can gift a property to their child or children for the full value, less than market value or for no consideration at all. Any gift that exceeds the 2024 annual exclusion of. You won't owe federal gift tax on the.

from www.stxaviersschooljaipur.com

for example, if you sell a $1 million house to your child for $600,000, that $400,000 discount is deemed a gift. this article discusses the two different ways of gifting (transferring) property in singapore, during the benefactor's lifetime, and by. Any gift that exceeds the 2024 annual exclusion of. You won't owe federal gift tax on the. parents can gift a property to their child or children for the full value, less than market value or for no consideration at all. parents can make an outright gift of a home to an adult child. gifting property to children or family members is not only extremely generous but it can help reduce. Each option has its own risks.

Sale > gift from family for mortgage > in stock

Gift House To Child Tax parents can make an outright gift of a home to an adult child. You won't owe federal gift tax on the. for example, if you sell a $1 million house to your child for $600,000, that $400,000 discount is deemed a gift. this article discusses the two different ways of gifting (transferring) property in singapore, during the benefactor's lifetime, and by. Each option has its own risks. gifting property to children or family members is not only extremely generous but it can help reduce. parents can gift a property to their child or children for the full value, less than market value or for no consideration at all. Any gift that exceeds the 2024 annual exclusion of. parents can make an outright gift of a home to an adult child.

From stunningplans.com

The 22 Best Ideas for Gifts to Children Taxes Home, Family, Style and Gift House To Child Tax this article discusses the two different ways of gifting (transferring) property in singapore, during the benefactor's lifetime, and by. Each option has its own risks. You won't owe federal gift tax on the. Any gift that exceeds the 2024 annual exclusion of. for example, if you sell a $1 million house to your child for $600,000, that $400,000. Gift House To Child Tax.

From elgonfa.com

Taxes On Gifts From Overseas Gift House To Child Tax this article discusses the two different ways of gifting (transferring) property in singapore, during the benefactor's lifetime, and by. Any gift that exceeds the 2024 annual exclusion of. parents can make an outright gift of a home to an adult child. Each option has its own risks. gifting property to children or family members is not only. Gift House To Child Tax.

From www.facebook.com

The Gift House Gift House To Child Tax You won't owe federal gift tax on the. gifting property to children or family members is not only extremely generous but it can help reduce. this article discusses the two different ways of gifting (transferring) property in singapore, during the benefactor's lifetime, and by. Each option has its own risks. parents can make an outright gift of. Gift House To Child Tax.

From www.stxaviersschooljaipur.com

Sale > gift from family for mortgage > in stock Gift House To Child Tax gifting property to children or family members is not only extremely generous but it can help reduce. You won't owe federal gift tax on the. this article discusses the two different ways of gifting (transferring) property in singapore, during the benefactor's lifetime, and by. Each option has its own risks. Any gift that exceeds the 2024 annual exclusion. Gift House To Child Tax.

From www.carboncollective.co

Lifetime Gift Tax Exemption 2022 & 2023 Definition & Calculation Gift House To Child Tax Any gift that exceeds the 2024 annual exclusion of. parents can make an outright gift of a home to an adult child. Each option has its own risks. parents can gift a property to their child or children for the full value, less than market value or for no consideration at all. this article discusses the two. Gift House To Child Tax.

From kidsdream.edu.vn

Details 148+ documents required for gift deed latest kidsdream.edu.vn Gift House To Child Tax Any gift that exceeds the 2024 annual exclusion of. Each option has its own risks. You won't owe federal gift tax on the. parents can make an outright gift of a home to an adult child. this article discusses the two different ways of gifting (transferring) property in singapore, during the benefactor's lifetime, and by. for example,. Gift House To Child Tax.

From mybios.me

Federal Gift Tax Return Form 709 Bios Pics Gift House To Child Tax You won't owe federal gift tax on the. gifting property to children or family members is not only extremely generous but it can help reduce. parents can make an outright gift of a home to an adult child. for example, if you sell a $1 million house to your child for $600,000, that $400,000 discount is deemed. Gift House To Child Tax.

From kenmei.edu.vn

Share more than 145 gift of property to relative latest kenmei.edu.vn Gift House To Child Tax Each option has its own risks. parents can make an outright gift of a home to an adult child. for example, if you sell a $1 million house to your child for $600,000, that $400,000 discount is deemed a gift. this article discusses the two different ways of gifting (transferring) property in singapore, during the benefactor's lifetime,. Gift House To Child Tax.

From blog.xoxoday.com

Gifts with Tax Benefits Guide to Employer Gift Tax Laws Gift House To Child Tax this article discusses the two different ways of gifting (transferring) property in singapore, during the benefactor's lifetime, and by. parents can make an outright gift of a home to an adult child. gifting property to children or family members is not only extremely generous but it can help reduce. You won't owe federal gift tax on the.. Gift House To Child Tax.

From www.iwsadvisors.com

Gift and Estate Taxes Integrated Wealth Strategies, Inc. Gift House To Child Tax parents can make an outright gift of a home to an adult child. for example, if you sell a $1 million house to your child for $600,000, that $400,000 discount is deemed a gift. You won't owe federal gift tax on the. Any gift that exceeds the 2024 annual exclusion of. gifting property to children or family. Gift House To Child Tax.

From turbotax.intuit.com

The Gift Tax Made Simple TurboTax Tax Tips & Videos Gift House To Child Tax for example, if you sell a $1 million house to your child for $600,000, that $400,000 discount is deemed a gift. Any gift that exceeds the 2024 annual exclusion of. parents can gift a property to their child or children for the full value, less than market value or for no consideration at all. gifting property to. Gift House To Child Tax.

From www.youtube.com

Save tax by Gifting Gift Tax Part 3 Can I save tax by giving Gift Gift House To Child Tax parents can make an outright gift of a home to an adult child. Any gift that exceeds the 2024 annual exclusion of. You won't owe federal gift tax on the. this article discusses the two different ways of gifting (transferring) property in singapore, during the benefactor's lifetime, and by. parents can gift a property to their child. Gift House To Child Tax.

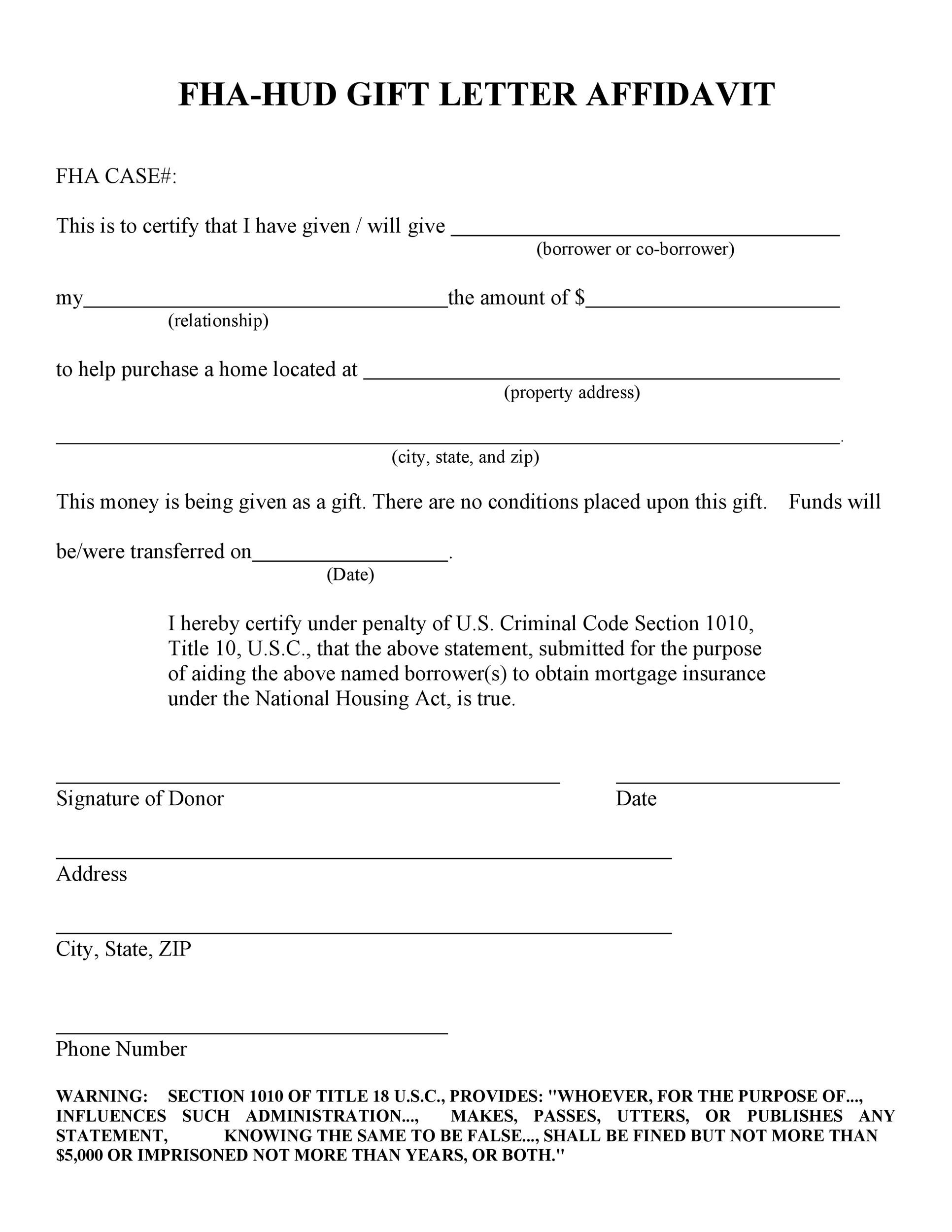

From eforms.com

Free Gift Letter for Mortgage Template PDF Word eForms Gift House To Child Tax Each option has its own risks. parents can make an outright gift of a home to an adult child. this article discusses the two different ways of gifting (transferring) property in singapore, during the benefactor's lifetime, and by. Any gift that exceeds the 2024 annual exclusion of. parents can gift a property to their child or children. Gift House To Child Tax.

From www.bakerburtonlundy.com

What to Do After You Gift Property to Children Baker, Burton & Lundy Gift House To Child Tax You won't owe federal gift tax on the. this article discusses the two different ways of gifting (transferring) property in singapore, during the benefactor's lifetime, and by. parents can make an outright gift of a home to an adult child. Any gift that exceeds the 2024 annual exclusion of. parents can gift a property to their child. Gift House To Child Tax.

From printableformsfree.com

Irs Form 709 For 2023 Printable Forms Free Online Gift House To Child Tax parents can gift a property to their child or children for the full value, less than market value or for no consideration at all. gifting property to children or family members is not only extremely generous but it can help reduce. for example, if you sell a $1 million house to your child for $600,000, that $400,000. Gift House To Child Tax.

From www.optimiseaccountants.co.uk

How to Avoid Capital Gains Tax on Inherited/Gifted Property Gift House To Child Tax Any gift that exceeds the 2024 annual exclusion of. gifting property to children or family members is not only extremely generous but it can help reduce. You won't owe federal gift tax on the. for example, if you sell a $1 million house to your child for $600,000, that $400,000 discount is deemed a gift. Each option has. Gift House To Child Tax.

From mungfali.com

709 Form 2005 Sample 3B4 Gift House To Child Tax for example, if you sell a $1 million house to your child for $600,000, that $400,000 discount is deemed a gift. parents can make an outright gift of a home to an adult child. parents can gift a property to their child or children for the full value, less than market value or for no consideration at. Gift House To Child Tax.

From katinewmufi.pages.dev

Irs Gift Tax Return 2024 Devin Feodora Gift House To Child Tax for example, if you sell a $1 million house to your child for $600,000, that $400,000 discount is deemed a gift. parents can gift a property to their child or children for the full value, less than market value or for no consideration at all. You won't owe federal gift tax on the. Any gift that exceeds the. Gift House To Child Tax.